Compliance by Design: Embedding Audit-Readiness into BFSI Applications with AI

In BFSI, where life savings, credit histories, and trillion-dollar transactions are at stake, there’s no room for error. Audits and compliance frameworks like SOC 2, ISO 27001, GLBA, and AML/KYC are critical—but navigating these strict, constantly evolving standards is challenging. AI delivers the accuracy and intelligence institutions need. With AI-powered compliance in BFSI, governance is embedded from day one to ensure output remains compliant, trustworthy, and audit-ready.

This blog explores how AI-powered compliance in BFSI reduces audit costs, automates governance within the SDLC, and strengthens regulator trust.

Understanding the Compliance-by-Design Framework (CDF) for AI-Powered Compliance in BFSI

CDF represents a fundamental shift from reactive to proactive compliance management. This approach embeds AI governance and regulatory compliance into every stage of the BFSI software development lifecycle.

For the BFSI sector—where operations face intense regulation, data sensitivity and cost of violations are critical —this framework ensures that applications remain audit-ready, secure, and regulator-trusted by default.

Implementing Compliance-by-Design in BFSI

The BFSI regulatory landscape spans a wide range of regulations: AML, KYC, GDPR, CCPA, SOX, Basel III, HIPAA, and SOC 2. Banks and insurers need systems that are regulation-ready from day one, with compliance controls built into their design.

The CDF delivers this assurance by embedding governance controls into every layer of the SDLC:

Regulatory Intelligence Integration – AI engines translate complex and evolving regulations into actionable requirements, so teams can implement updates quickly without manually interpreting every new rule.

Policy-First Architecture – Pre-configured templates for encryption, data retention, and access controls ensure that governance is built into infrastructure, minimizing human errors and misconfigurations.

Continuous Monitoring & Audit Logging – Automated logging and immutable audit trails provide clear evidence for regulators while reducing the burden of manual checks.

AI-Enabled Risk Detection – Machine learning models proactively flag unusual transactions, access patterns, or behavior anomalies, strengthening fraud prevention and compliance readiness.

Explainable AI (XAI) – AI decisions are transparent and traceable, enabling compliance officers and regulators to understand why specific cases were flagged, supporting accountability. Deep dive further in to the topic with the blog Transparent & Explainable AI in Regulated SDLCs

Governance in CI/CD Pipelines – Compliance checks are embedded in development and deployment cycles, ensuring every update or feature is released with governance controls intact.

The result is a proactive compliance posture that drives innovation, secures regulator trust, and avoids costly audit setbacks.

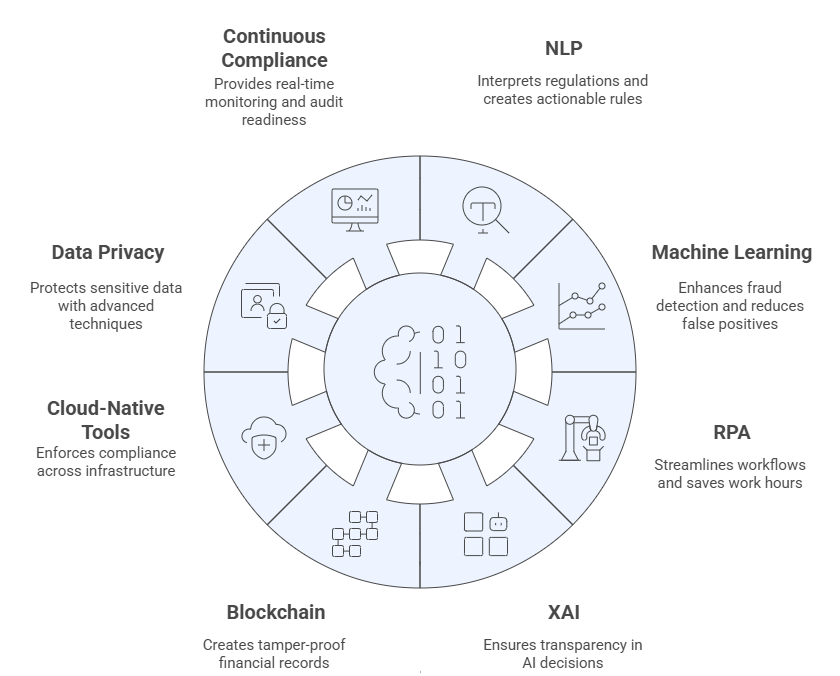

The Technology Stack Powering CDF

Behind this framework lies a sophisticated RegTech ecosystem tailored for BFSI. From cloud-native infrastructure and AI monitoring tools to compliance automation platforms and immutable audit logs, each layer is designed to make governance practical and scalable.

Strategic Gains of AI-Powered Compliance in BFSI

AI-powered compliance delivers more than operational efficiency—it strengthens the institution’s strategic foundation.

- Resilience: By embedding controls into every stage of the SDLC, systems remain regulator-trusted even as standards evolve, minimizing disruption during audits or policy changes.

- Trust: Transparent and explainable AI builds confidence among both regulators and customers, showing that compliance is not an afterthought but a core design principle.

- Risk Posture: Proactive monitoring and anomaly detection reduce the likelihood of penalties, remediation costs, and reputational damage. Institutions gain the freedom to innovate without fear of compliance setbacks.

This shift positions BFSI organizations to operate with confidence—secure, compliant, and future-ready.

Navigating the Challenges of AI in BFSI Compliance

While the benefits of AI-powered compliance in BFSI are clear, implementing it comes with challenges that must be carefully addressed:

- Data Quality and Fragmentation: AI effectiveness relies on clean, unified data, and legacy or siloed systems can severely limit its predictive accuracy and coverage.

- Regulatory Uncertainty: AI in BFSI must navigate constantly evolving regulations, making consistent compliance across multiple frameworks a complex challenge.

- Explainability and Trust: General-purpose AI can produce opaque outputs, so XAI frameworks are essential to ensure full transparency for regulators and auditors.

- Human Oversight Requirements: AI cannot replace human judgment in high-risk scenarios, making continuous human-in-the-loop (HITL) oversight essential for accountability and compliance.

- Cybersecurity and Privacy Risks: BFSI data is highly sensitive, requiring AI systems to comply with strict encryption, access control, and privacy laws to avoid breaches and regulatory penalties.

- Implementation Costs and Talent Gaps: Deploying AI on a scale with legacy systems while ensuring regulatory compliance demands substantial investment and scarce specialized skills.

- Model Bias and Fairness Concerns: AI trained on biased datasets can unintentionally reinforce discrimination, making bias detection, mitigation, and continuous retraining essential.

V2Solutions' Governance-First SDLC: Making Compliance Automatic

At V2Solutions, we’ve operationalized CDF through our Governance-First SDLC, embed compliance guardrails across every stage of the lifecycle:

- Plan: Map business requirements to compliance with frameworks from the start.

- Build: Integrate AI-driven compliance checks into development pipelines.

- Test: Apply continuous monitoring and pre-audit validation.

- Deploy & Operate: Automate reporting, controls, and documentation.

Your Next Step: Build Compliance with Your Organization's DNA

Here’s the critical question: Is your BFSI application truly audit-ready—or are you simply hoping for the best when regulators come calling.

With regulators continuously tightening requirements and customers demanding unprecedented transparency, Compliance by Design has moved from competitive advantage to absolute necessity.

The organizations that recognize this shift now find themselves ahead of both regulatory requirements and competitive pressures.

Adopting AI-powered compliance in BFSI ensures your applications remain regulator-trusted. Connect with our experts for more information on audit-ready AI-powered applications.