Composable Credit Architecture: Engineering Modular Fintech Applications with Domain-Driven Design for Enhanced CX

Monolithic systems don’t belong in modern credit services.

Yet, many fintechs continue to duct-tape new features onto legacy cores—creating brittle systems, accumulating technical debt, and slowing down time-to-market. Meanwhile, customer expectations around instant credit approvals, real-time updates, and personalized offers keep rising.

If you’re still building in a tightly coupled codebase, you’re shipping friction as a feature.

Composable architecture—anchored in Domain-Driven Design (DDD) and deployed via bounded contexts, hexagonal patterns, and OpenAPI-based contracts—offers a path forward. Not just for cleaner code, but for real business impact: faster iteration cycles, lower operational risk, and up to 35% improvement in customer experience metrics.

This isn’t just theory. It’s an engineering strategy built for fintechs who are serious about scale, agility, and modular evolution.

Why Fintech Teams Are Ripping Out Monoliths

Monoliths age like milk in fintech.

Each new regulation, partner API, or CX initiative requires changes that ripple unpredictably through the entire system. Even worse, credit systems are inherently domain-rich: onboarding, scoring, compliance, underwriting, disbursal, collections—each has distinct logic, yet are often handled by overlapping models and services in a monolith.

The Problem with Monolithic Credit Systems

- Fragile deployments (one bad line takes everything down)

- Sluggish release cycles (months to ship minor feature updates)

- Tight coupling between channels, UIs, and business logic

- Painful scaling (vertical scaling gets expensive quickly)

The architecture becomes the bottleneck to business growth. That’s where composable credit architecture kicks in.

Composable Architecture: A Modular Approach That Aligns with Credit Realities

Composable architecture isn’t just microservices with a new name. It’s about decomposing systems into autonomous, cohesive components aligned to specific business capabilities, not just technical layers.

In the context of fintech applications, composability means breaking down complex credit operations into manageable, independent services. Each service owns its data, implements its business logic, and exposes well-defined interfaces for interaction with other components. This modularity enables teams to develop, test, and deploy services independently, dramatically reducing time-to-market for new features.

In credit services, that means structuring your application into discrete services like:

- Onboarding-Service (identity, KYC, AML)

- CreditProfile-Service (score, behavior, history)

- LoanDecisioning-Service (pricing, approvals, policy checks)

- Disbursal-Service (funds routing, bank integrations)

- Collections-Service (payment retries, NPA handling)

- Notifications-Service (SMS, WhatsApp, email updates)

Each service is self-contained, owns its own data, and exposes well-defined APIs—enabling faster iteration, better fault isolation, and true CI/CD independence.

You’re no longer updating an entire stack to make changes to one business rule. You’re shipping improvements to just the service that owns that rule.

For a deeper dive into modular system design patterns, see our Composable Architecture for Scalable Enterprise Apps whitepaper.

Domain-Driven Design: Structuring Credit Applications with Contextual Boundaries

At the heart of composable architecture lies Domain-Driven Design (DDD). DDD gives you the mental model to structure systems that reflect the business, not just the database. It emphasizes deep understanding of the business domain and creates software models that reflect real-world processes and constraints.

In credit systems, this is non-negotiable.

Let’s say your collections team wants to experiment with flexible repayment plans. In a tightly coupled system, that request triggers changes across loan, repayment, and notification modules—making testing and deployment painful.

With DDD, each domain—collections, repayment, customer communication—is a bounded context. It has:

- Its own data model (not shared across services)

- Its own language (e.g., “NPA” in collections means something different than “risk category” in underwriting)

- Its own lifecycle and rules

This separation avoids “accidental coupling” where one change breaks unrelated parts of the system.

It also makes collaboration easier. Each product squad can own a bounded context without constantly syncing with the rest of the org.

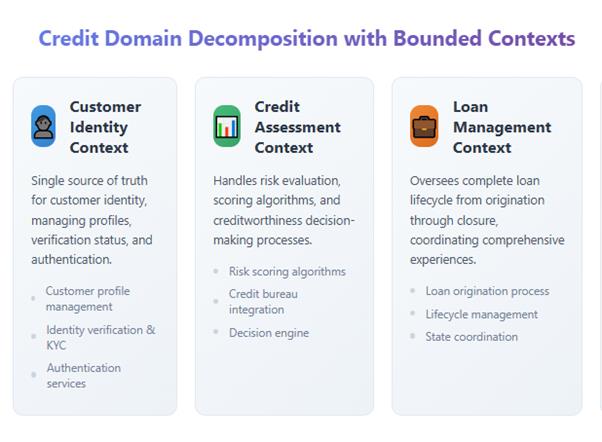

Decomposing the Credit Domain with Bounded Contexts

Effective credit system decomposition requires careful analysis of business capabilities and their interdependencies. Bounded contexts serve as the fundamental building blocks for this decomposition, each representing a distinct business capability with clear ownership and responsibility.

Hexagonal Architecture: Decoupling the Core from the Chaos

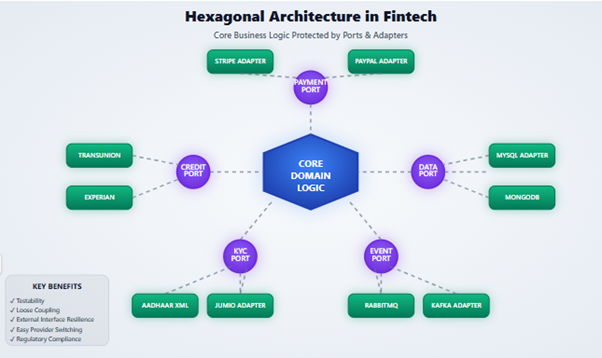

Hexagonal architecture, also known as ports and adapters pattern, provides the structural foundation for implementing bounded contexts in composable systems.

In fintech applications, hexagonal architecture proves particularly valuable due to the complexity of external integrations. Credit systems must interact with numerous third-party services: credit bureaus, payment processors, regulatory reporting systems, and partner APIs. Hexagonal architecture isolates these dependencies behind adapters, protecting core business logic from external changes.

Composable fintech systems aren’t just modular—they’re also port-agnostic. You can’t afford to re-architect every time you swap a database, payment gateway, or third-party API.

This is where Hexagonal Architecture comes in.

For real-world patterns of event-driven scaling in fintech, check out our blog on event-driven microservices.

Core Idea Behind Hexagonal Design

- The core domain logic is at the center. It doesn’t know or care about REST, SQL, or Kafka.

- Ports define the expected interactions (e.g., CreditScorePort, KycProviderPort)

- Adapters plug into those ports (e.g., TransUnionAdapter, AadhaarXmlAdapter, MySQLAdapter)

Need to switch from Experian to TransUnion? Just implement a new adapter. The domain model doesn’t change.

This pattern enforces testability, loose coupling, and external interface resilience—key when integrating with unreliable partners or evolving regulations.

Contract-First Development with OpenAPI for Seamless Integration

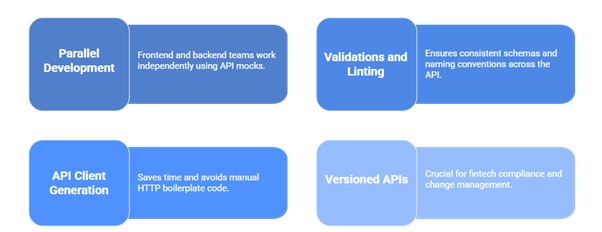

Contract-first API design using OpenAPI specifications establishes the communication protocols that enable composable architecture. Rather than implementing services first and documenting APIs afterward, contract-first development defines interface contracts before implementation begins.

This approach provides numerous benefits for fintech development teams. OpenAPI specifications serve as executable documentation, enabling automatic generation of client libraries, server stubs, and testing frameworks. Teams can work in parallel on different services using shared contract definitions, reducing integration delays and miscommunication.

In credit services, contract-first development ensures consistent data models and interaction patterns across all system components. Whether handling loan applications, payment processing, or customer communications, all services adhere to well-defined contracts that facilitate seamless integration.

OpenAPI specifications also support version management, enabling backward-compatible API evolution. As business requirements change, teams can extend contracts without breaking existing integrations, supporting the rapid iteration that composable architecture promises.

Benefits of Contract-First Development

The Engineering Payoff: What You Get by Going Composable

Moving to a composable, DDD-aligned architecture is not just architectural purity. It delivers clear technical and business outcomes:

CX Is the Outcome: Better Where It Matters

All this tech pays off where it counts—customer experience.

Composable systems enable:

- Real-time pre-approvals with ML scoring services that scale independently

- Dynamic loan products configured on the fly per user profile

- Transparent repayments with self-serve UIs pulling directly from modular APIs

- Multichannel touchpoints (app, WhatsApp, email) powered by decoupled comms services

The customer experience improvements achieved through composable architecture stem from both technical capabilities and business process optimization. Organizations implementing these approaches report substantial enhancements across key customer experience metrics.

Reduced time-to-approval results from parallel processing capabilities enabled by service decomposition. Instead of sequential processing through a monolithic application, credit applications can flow through specialized services simultaneously, dramatically reducing approval timeframes.

Personalized customer journeys become feasible when individual services can be combined dynamically based on customer profiles and preferences. The composable approach enables rapid assembly of tailored experiences without extensive custom development.

Improved system reliability through fault isolation and service redundancy creates more consistent customer experiences. Customers encounter fewer system-wide outages and benefit from graceful degradation when individual components experience issues.

Faster feature delivery enables organizations to respond quickly to customer feedback and market opportunities. New capabilities can be developed and deployed incrementally, allowing continuous improvement of customer touchpoints.

How V2Solutions Delivers Composable Fintech Systems That Actually Work

Too many consulting partners throw around buzzwords without delivering production-grade systems. At V2Solutions, we bring deep technical implementation experience to every composable architecture engagement.

Our fintech engineering teams specialize in:

- Identifying true bounded contexts across credit, collections, risk, and CX

- Designing hexagonal microservices from existing monoliths with zero downtime

- Enabling OpenAPI governance for external and internal APIs

- Setting up robust observability, tracing, and failover for high-risk financial flows

We’ve built composable credit architectures for B2C lenders, embedded finance startups, and B2B SaaS platforms—and we can help your team ship faster, safer, and smarter.

Conclusion: This Is the Architecture That Wins in Fintech

Composable credit architecture isn’t a silver bullet—it’s a deliberate, architectural commitment to modularity, business-aligned service design, and customer-first engineering.

With Domain-Driven Design guiding your bounded contexts, hexagonal patterns keeping your core pure, and OpenAPI contracts streamlining integrations, your fintech platform becomes not just flexible—but productively evolvable.

And with V2Solutions, you gain a partner who has walked this path before and can help you avoid the common pitfalls. Because in fintech, speed matters. Scale matters. But what matters most is building systems that are ready for what’s next.